Establishing Trusts

A valid Florida trust could be described as a legal relationship in which a trustee holds legal title to and manages the property to serve the best interests of the beneficiary(ies) who hold equitable title to the property. A settlor with legal capacity can create trusts, and the intent is to set up a gift in trust (language in the trust document to the effect of “in trust” will satisfy this requirement). The settlor can revoke a revocable living trust. The settlor may create a trust that becomes effective before his or her death.

This is known as a living trust or an inter vivos trust. The trust must be created for the benefit of at least one beneficiary who will be entitled to enforce the terms of the trust. The beneficiary need not exist at the time of creation (e.g., any unborn heirs or children). The trust must also contain property (real estate or personal property that was owned by the settlor at the time the trust was formed, as well as life insurance benefits and contents of a bank account) and have a valid purpose. To be valid, the purpose must be lawful, not contrary to public policy, and possible to achieve. For example, a valid trust purpose may be to serve as a planning tool for the support of a relative or loved one. All trusts are within the jurisdiction (control) of Florida state courts. Thus, they may not be enforced in federal court.

However, a court is permitted to strike (remove and disregard) trust provisions that are found to be invalid or contrary to the intent of the settlor and enforce the remaining provisions. In Florida, all trusts are presumed to be revocable trusts (may be canceled) unless the trust document states that the trust is irrevocable. Trusts that only contain personal property may be valid if they were created orally (including trusts declared orally on video). However, trusts that seek to transfer ownership interests in real estate are subject to Florida’s statute of frauds. So they are required to be in writing that states the essential terms of the transaction, such as the parties and a legal description of the land to be transferred.

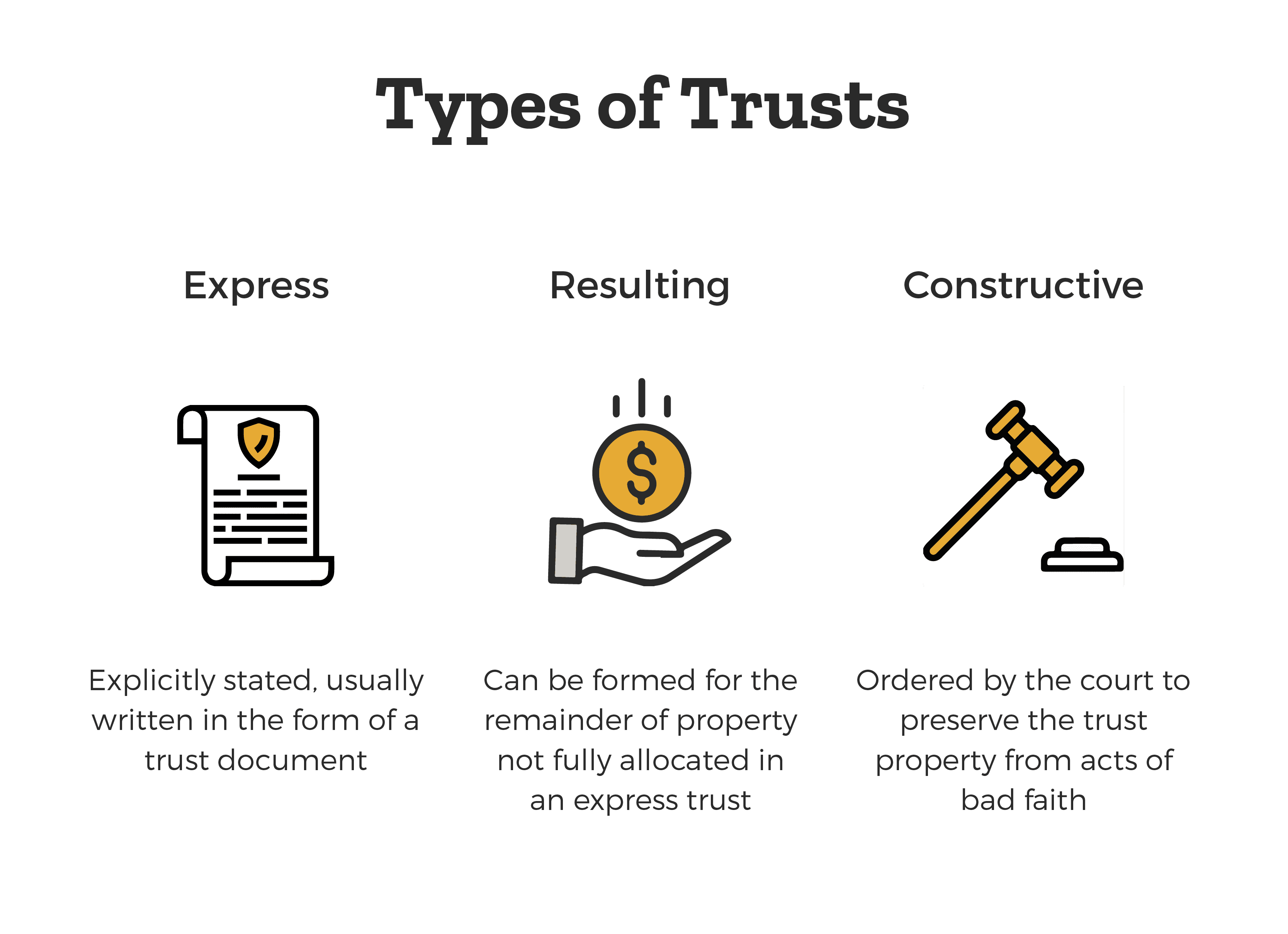

Florida law recognizes three main types of trusts: express, resulting, and constructive. An express trust is based on the settlor’s intent, which must be stated explicitly (usually written in the trust document). The settlor’s intent in achieving the purpose of the express trust is the controlling factor that a court will consider at all times when enforcing an express trust. A resulting trust occurs if the property in an express trust is not fully allocated. A court may order the creation of a constructive trust if it is necessary to preserve the trust property from acts in bad faith, such as fraud, duress, or undue influence. Constructive trusts are not based on settlor intent.

When interpreting the terms of the trust document, the court is limited to the terms as they are written in the trust document. The court is generally not permitted to consider any other outside evidence (extrinsic evidence). The words in the trust document are given their most common meaning. This is legally known as the plain meaning rule. However, if the meaning of terms in the trust document is unclear, outside evidence may be admitted to clarify their meaning. All express trusts in Florida are governed by the Florida Trust Code (FTC). In the event that a settlor’s property is not fully disposed of by the trust (e.g., when an express trust fails), a resulting trust may be created by a court based on the circumstances surrounding the trust.

Trusts may also be created in the terms of a valid will. These types of trusts are known as testamentary trusts. Wills containing testamentary trusts often also contain pour-over provisions, which dispose of the testator’s property in accordance with an administrative probate process as a part of the probate estate upon the occurrence of certain conditions specified in the will. Testamentary trusts are also required to conform to certain Florida laws that govern wills. Testamentary trust distributions may still be subject to state-level estate taxes or federal estate taxes.

Many people hire attorneys who specialize in estate planning or an estate planning attorney to ensure that the trust formation process is done correctly and completely. An attorney may also be appointed to serve as a trustee. Any party to a trust may hire an attorney of their choosing, but the state will not provide one to the testator at no cost. The trustee may also be a corporate trustee such as a bank or trust company capable of accepting fiduciary responsibility. The trust may contain a provision to designate a set of laws (e.g., a specific state) that will govern it (choice of law provision). Absent a choice of law provision, the trust will be controlled by the laws of the location where the settlor lived at the time the trust was created.

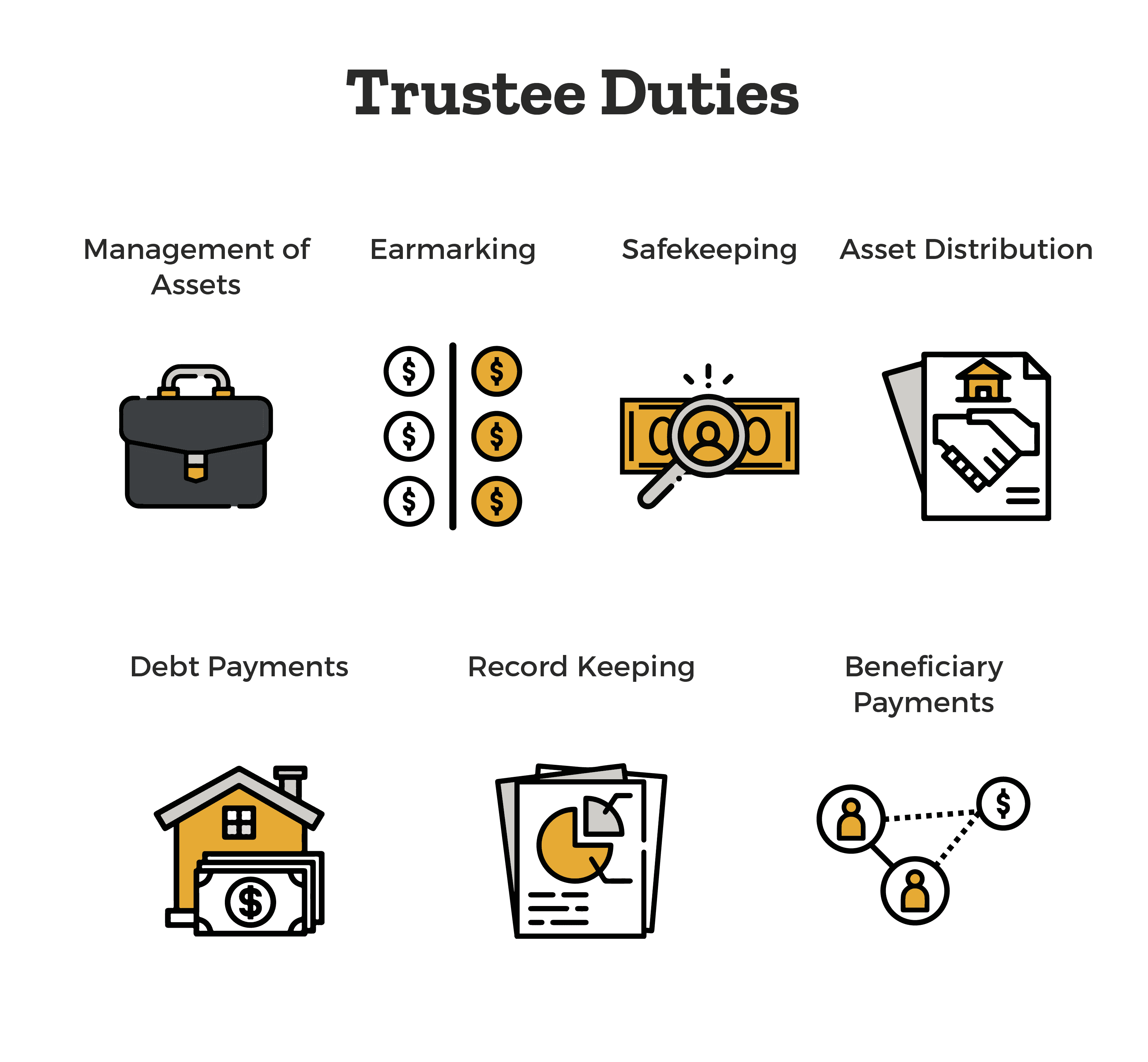

As previously mentioned, trustees are charged with specific duties relating to achieving the trust’s purpose. To qualify as a trustee, a person need only have legal capacity (usually interpreted to mean those who are 18 years and older and have not been declared legally insane or are under the supervision of a guardian ad litem). A trustee is not required to be a surviving spouse or loved one related to the settlor. A trustee may accept the role by expressly agreeing to become a trustee or by beginning to perform the trustee’s duties. These duties generally include: management of trust assets, separation of trust property from nontrust property (earmarking), safekeeping trust property (e.g., purchasing insurance), distributing trust assets, paying trust debts, keeping accurate trust records, and making payments to the beneficiaries.

A trustee has a fiduciary duty to the beneficiaries. These duties include a duty of loyalty and to maintain certain standards of care when performing trust duties. Most notably, the prudent investor rule requires that the trustee make reasonable decisions relating to the investment of trust funds or property. This duty prohibits the trustee from using trust funds for purposes that are illegal, contrary to the settlor’s intent, or to improperly enrich the trustee (self-dealing). Any transactions entered into by the trustee that a court determines to be based in self-dealing may be voided (canceled). The trust may include spendthrift provisions, which describe the appropriate ways in which a trustee may spend trust funds or sell trust property.

The trust may specify the amount that a trustee is to be paid for performing trust duties. However, if the trust is silent as to trustee compensation, the trustee may be paid any amount that is necessary and reasonable given the unique circumstances of each trust administration. A trustee is also entitled to reimbursement from the trust funds for expenses incurred as a result of performing trust duties. A trust may fail if a trustee does not fulfill trust obligations or deviates from trust fiduciary duties. In which case, a trustee may also be removed from his or her position as a trustee. A trust beneficiary may also request that the court remove a trustee. The court can also remove the trustee independently for cause. The trust may name alternative or successor trustees to replace a removed trustee. If the trust is silent as to successor trustees, the beneficiaries may unanimously appoint one. If neither option works, the court may also appoint a new trustee.

A trust may terminate or end for many reasons, such as when the trust expires, the trust is revoked, or the trust purpose has been completely fulfilled. A trust may also terminate if the purpose of the trust becomes illegal, impossible, or wasteful to achieve. In this case, a court may act to modify or terminate a trust in a manner that conforms as closely as possible to the settlor’s intent. In other words, the court will determine an appropriate resolution of the trust according to the court’s interpretation of the settlor’s purpose in creating the trust. This process is called cy-pres. A trust may also terminate if a beneficiary dies before the fulfillment of the trust purpose.

The general rule is that if the trust document states grounds for trust termination, those terms control. However, the trust may also be modified or canceled if the settlor and all beneficiaries agree to the change. The trustee’s consent is not required. Upon the death of the settlor, the trustee and beneficiaries may agree to modify or terminate the trust unanimously. Also, a beneficiary’s interest depends on his or her survival until the time that trust property is to be completely distributed. If a beneficiary does not survive until such time, the gift is said to have lapsed. Florida has a so-called antilapse statute, which states that a lapsed gift will be distributed to the surviving relatives of the beneficiary in descending priority (per stirpes).