Understanding Home Loans in Florida

When discussing homeownership in Florida, an essential link used to bridge the gap between the price of real estate and prospective buyers is the mortgage. A mortgage is a document that conveys title (legal ownership interest) to a buyer (the mortgagor) and gives the lender (the mortgagee, usually a bank) a security interest in the property being sold (the collateral), which in turn guarantees the payment of the home loan debt.

This commitment may be owed to another person or organization other than the homebuyer. The lender may also require a down payment and charge a reasonable interest rate for financing the loan. A mortgage with an interest rate that never changes throughout the loan is called a fixed-rate mortgage. Alternatively, a mortgage that is subject to an interest rate that changes is called an adjustable-rate mortgage. The mortgage rate is a major factor in determining the monthly payment owed on the home loan.

The best mortgage available to a buyer can save money over the long term. Most often, the conventional loan duration is a 30-year fixed mortgage. However, the type of loan program that a buyer may be offered depends on factors like the loan amount, loan type, home value, and the borrower’s credit score. In Florida, first-time homebuyers may receive public assistance with making their down payment. The Federal Housing Administration (FHA) governs the standards of all home loans and current mortgage rates. However, many lenders obtain licensing to grant mortgages through the Nationwide Multistate Licensing System and Registry (NMLS).

A mortgage that is granted to buy a home is also known as a purchase money security interest (PMSI) because the money is being loaned for the sole purpose of purchasing a home or property that is subject to the mortgage. This is important to note because, in the event of a homebuyer’s bankruptcy, a lender who granted this type of mortgage will be given priority when making a claim to satisfy the debt. The PMSI lender will be given the first opportunity to take possession (foreclosure) and sell the property (forced sale) to satisfy the debt before all other mortgages, regardless of whether the other loans were recorded in the applicable government property records. If multiple lenders make PMSI claims to the property, the first (older) PMSI will be considered a senior interest and will be granted priority to forced sale, and all other claims (junior interests) may be extinguished (discharged). This procedure is known as first in time, first in right.

Another type of Florida mortgage that lenders are permitted to grant is the future advance mortgage, which is more commonly referred to as a line of credit. This type of mortgage also allows the lender to acquire a financial interest in the home or property to secure the debt, but the purpose of the loan is different from that of the PMSI in that the money will be loaned for a future purpose other than the purchase of the home or property (e.g., home improvements). As a result, future advance mortgages will be considered junior mortgages and will be defeated by any PMSI claims to the property whether they were granted before the PMSI or not. There are some alternatives methods of purchasing real estate besides the traditional mortgage. A homeowner may also grant a lender a deed of trust. In this case, the borrower will deliver the deed to a trustee who will hold the deed until the borrower repays the loan in full. In turn, the lender will return the deed to the homebuyer. A seller may also keep the deed to the property until the loan is completely satisfied and then convey the title to the borrower. This type of transaction is called an installment land contract.

The general obligations of a mortgagee are to lend money and convey title. The mortgagor must repay the debt in full and not commit waste (this is a duty to maintain the property and not destroy it). However, there are many other more specific obligations relating to the mortgage process, especially in the event of a sale, foreclosure, and judicial sale. One major factor that determines the nature of these obligations is the rules that govern mortgages in the state that the mortgage was granted.

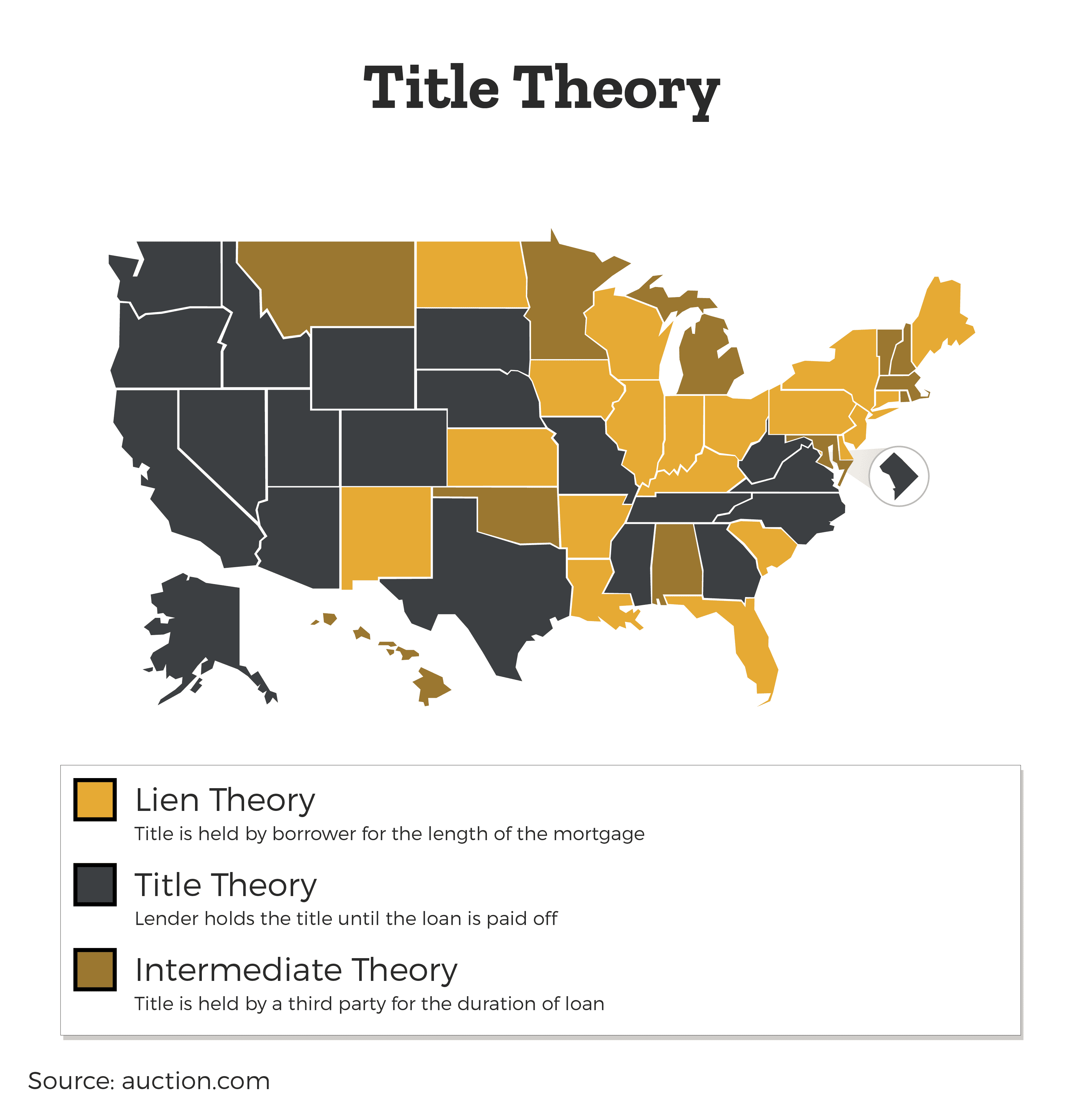

For example, each state has rules that determine the effect that a mortgage has on property owned jointly by more than one party (e.g., husband and wife have title to a home). This is generally known as joint tenancy or joint title. The majority of states consider a mortgage to be a lien. The borrower holds the lien, which must be paid at the time of a sale, but it does not sever the joint tenancy, thus the homebuyer holds the title to the home. This is called a lien theory state. Florida follows the lien theory of mortgages and does not sever tenancies based on the existence of a relevant mortgage. The minority of states follows the title theory. In this case, the lender holds the home title until the loan is paid off, at which point the borrower receives the title. There is also the intermediate theory in which the home title is held in trust by a third party until the debt is paid.

There are also several Florida laws that govern the transfer of property ownership when mortgages are involved. A common question that may arise is: What happens to a mortgage when a home is sold? The answer depends on the specific terms of each individual transaction that are written in the sales contract. There are two common types of situations: the buyer will either assume the mortgage or be subject to the mortgage. If a buyer is subject to a prior mortgage, then they will assume payments, but the seller will still be liable to the lender. But if a buyer assumes a mortgage, then they take on the sole liability.

As mentioned earlier, a mortgage lender may repossess and forcibly sell a property to satisfy the debt owed on the property. This procedure is called foreclosure. Foreclosure has the effect of terminating the homeowner-borrower’s ownership interest in the home or property. The most common type of foreclosure in Florida is judicial foreclosure. This type of foreclosure is overseen by a judge and involves standard legal steps. In this case, the homeowner is entitled to a notice and hearing on all foreclosure issues. A homeowner may hire an attorney at his or her own expense to assist with defending against foreclosure. Florida does not provide attorney representation in foreclosure cases.

A mortgage is mostly based on its underlying obligation. Some common defenses that may defeat a foreclosure include: mistake, fraud, lack of legal capacity, and duress. In the majority of states (including Florida), a mortgage lender cannot enforce the mortgage without producing the original loan documentation. This type of situation can occur, as obligations are frequently bought and sold to other lenders and documents can become lost in the transfer. Fortunately, the Florida constitution also provides what is called homestead protection. This means that property of unlimited value up to a half-acre of municipal land or 160 acres of rural property is protected from forced sale and liens from creditors. To qualify, the owner must be a natural person (no organizations or corporations), the property must be located in Florida, and it must be the property on which a Florida resident primarily and permanently lives.

Before foreclosure begins, a homeowner is entitled to a right of redemption. This means that the borrower may pay the entire balance owed on the mortgage debt and obtain a clear title to the property. Most mortgages contain language known as due on sale clauses that detail the lender’s right to make the entire sum of the debt due immediately upon default. Also, many states provide a statutory right of redemption. This is a right to repay the loan in full after a foreclosure has begun, as provided by a statute. Anyone with a related interest in the borrower’s mortgage may exercise rights of redemption.

In many instances, banks may agree to change the terms of the loan to assist the homeowner in avoiding default. This may be achieved by executing a new loan on the property, which is called a refinance or refinancing. Or it may be done via changing the terms of the loan on its face. This is called loan modification. The homeowner may also avoid the lengthy and complicated foreclosure process by providing the lender with a deed in lieu of foreclosure. In this situation, the borrower conveys the deed to the property to the lender and the lender initiates a forced sale.

Sources

- https://www.law.cornell.edu/wex/mortgage

- https://www.auction.com/blog/lien-theory-states-vs-title-theory-states/

- https://www.prepagent.com/article/assume-vs-subject-to

- https://www.alperlaw.com/asset-protection/florida-asset-protection/homestead-law/