Alimony Laws in Florida

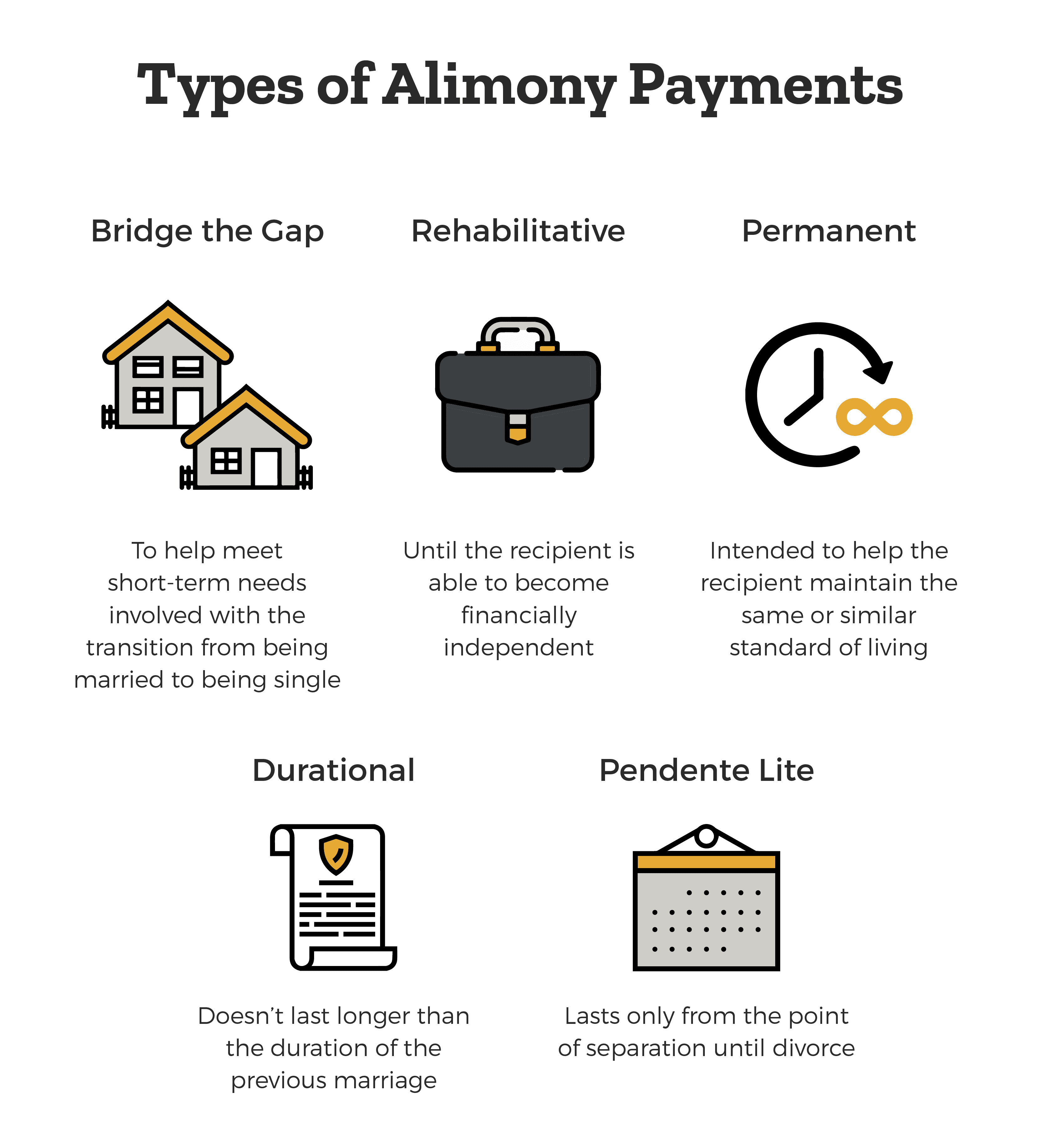

Alimony is a form of spousal support paid between people who are married and will be divorced or are currently divorced (ex-spouses). Florida alimony is usually decided as a part of resolutions to divorce cases. Florida alimony law is based on the idea that one spouse has a need, and the other spouse can pay. So alimony is completely separate and different from child support, palimony, and all other types of familial support. Alimony may not be discharged in bankruptcy. Florida law recognizes five types of an alimony award, and they are: bridge the gap, rehabilitative, permanent, durational, and pendente lite. All divorce cases involving alimony are within the jurisdiction (control) of state courts. So the type of award is based on the unique circumstances of each situation. For tax purposes, alimony is considered taxable income as applied to the spouse receiving the alimony payments. On the other hand, alimony is tax deductible for the paying spouse.

This is not the case for other support payments, though, such as child support. A spouse may be ordered to pay alimony in cases that involve a spouse who has been legally declared mentally incompetent. Spouses can also agree to receive a lump sum or periodic alimony payments. A spouse may hire a divorce attorney to represent them throughout the alimony process at the spouse’s own expense. Many law firms and divorce lawyers also provide free consultations for Florida divorces. But Florida does not provide attorneys at no cost for family law cases. A law firm or lawyer is not allowed to represent both spouses who are seeking dissolution of marriage.

Family courts in Florida have many relevant factors they may consider when deciding which form of an alimony award is appropriate as defined by alimony law contained within Florida statutes. For example, a fairly common case may involve one spouse who works full time and earns most or all of the household income. A court may consider a difference in the earning capacity, financial resources, and marital assets of the spouses when determining whether an award of alimony is appropriate.

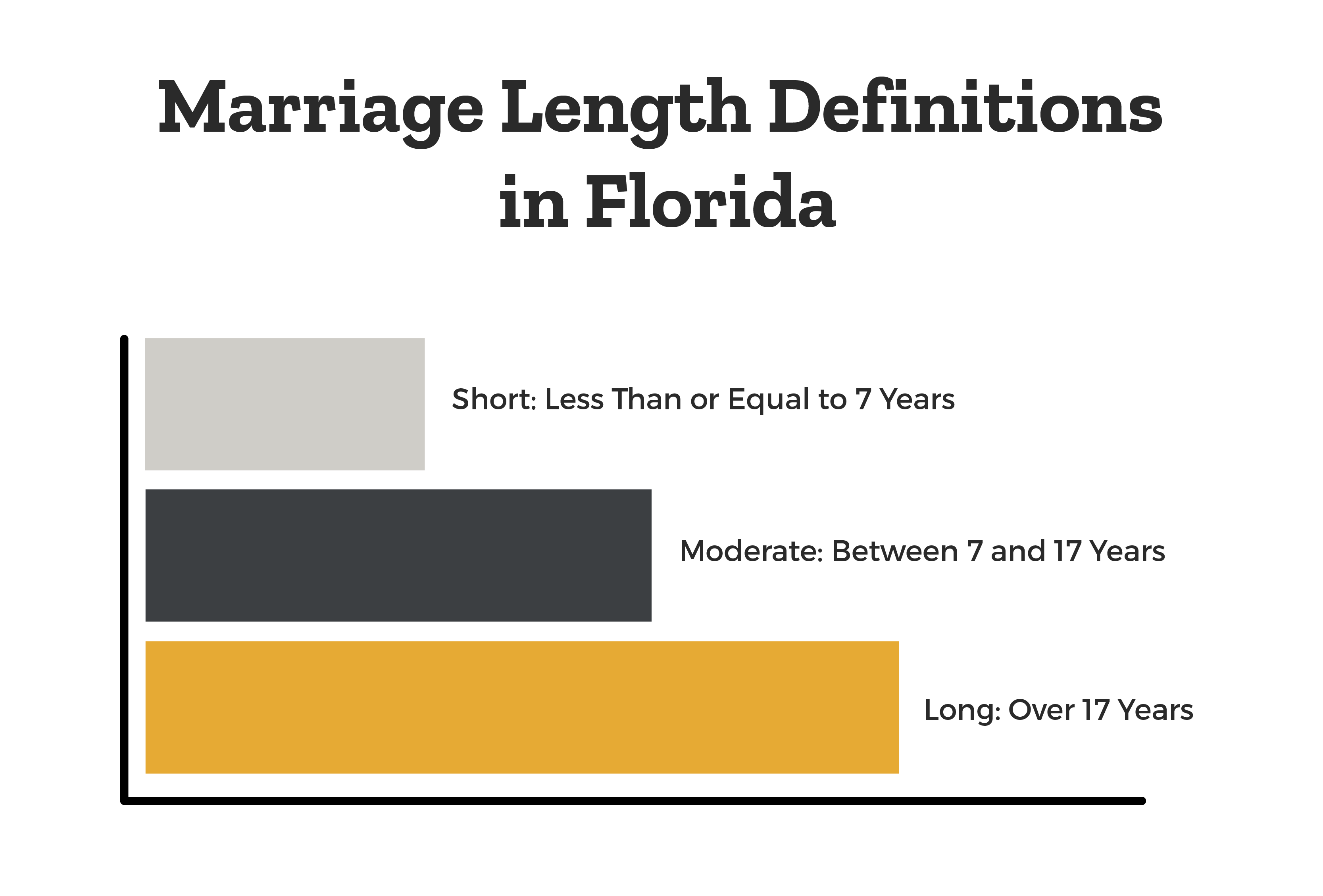

Another major factor to be weighed by the court is the period of time that the parties were married or the length of the marriage. Florida considers the length of the marriage in the following format: a short-term marriage lasts seven years or less, a moderate duration marriage last more than seven years but less than seventeen years, and a long-term marriage lasts seventeen years or more. In other words, the longer the marriage, the longer the duration that an alimony award will tend to be. Courts can consider other factors such as the standard of living that the couple maintained during the marriage, the time needed for the recipient to gain an education and/or employment, marital misconduct (infidelity, adultery, etc.), minor children, the cost of child care, the health of the spouses (to include the physical condition, emotional condition, and mental health), and income. Family courts may also order a paying spouse to maintain a life insurance policy up to the amount of the alimony award to secure alimony in the event of the payor’s spouse’s death.

Most alimony payments may be modified (changed) when the paying spouse can show that exceptional circumstances or a substantial change in circumstances have happened that significantly affect either the need to receive or ability to pay alimony. This can be shown by either a change in the financial needs of the payee or a change in the payor’s ability to continue paying the same amount of alimony. A court is also allowed to consider the voluntary retirement of the paying spouse from his or her job in these situations. However, a spouse may not modify their support payments because they intentionally reduced their own income. For example, if a paying spouse intentionally quits their job, the paying spouse may not modify to reduce their payments due to this (being that it was intentional). To receive an alimony modification, the spouse looking to modify must file a petition in state court that gives the reasons for the modification. Then, a hearing will be scheduled to determine if a modification is needed. The other spouse must be given sufficient notice of the hearing and an opportunity to attend the modification hearing. But if the modification is being sought in the same court that originally issued the alimony, jurisdiction does not have to be established because the court is automatically considered an appropriate venue by law.

Florida law also provides that alimony may also be modified or terminated upon the death of either spouse (the deceased person’s estate will not have to continue paying alimony). It may also be modified or terminated upon remarriage of the dependent spouse and when the recipient enters into a supportive relationship. A supportive relationship generally means that the recipient is living with and/or receiving financial assistance in some way from someone who is not a family member. The supportive relationship does not need to be conjugated. There are several factors that a court may look at when determining if a supportive relationship exists. Some examples of this would be: the length of time that has passed since the recipient has lived with the other person, if the couple have presented themselves in public as a couple, whether the couple has bought property jointly (land or personal), contributions to supporting each other’s children, and the amount of support one person paid to the other.

Five Alimony Types

Bridge the Gap

Bridge the gap alimony is intended to assist the recipient in meeting the identifiable short-term needs involved with making the change from being married to being single. This type of alimony cannot be modified, and it is limited to a two-year duration.

Rehabilitative

Rehabilitative alimony is based on the idea that the recipient is seeking new education and/or appropriate employment to become more financially independent. This must come with a plan that describes how the rehabilitation plan is to happen. Rehabilitative alimony may be modified if there is a substantial change of circumstances, if a spouse fails to follow the plan, or if the plan has been fulfilled. Remarriage does not automatically terminate alimony in this case, but it may be considered as a factor when deciding if a supportive relationship exists.

Permanent

An award of permanent alimony is intended to help the recipient maintain the same or similar standard of living that the spouses enjoyed during the marriage. Generally, permanent alimony is to last the remainder of the receiving spouse’s life. So courts are only allowed to grant it when no other form of alimony is fair and reasonable. This mostly depends on the length of the marriage (the amount of time that the couple was married). As previously noted, a long-term marriage is legally considered to last seventeen years or more. The majority of cases in which permanent alimony is awarded are long-term marriages. But there are certain exceptions to this, which could be given in short- and moderate-term marriages. Permanent alimony may also be modified upon substantial changes in circumstances and cases involving a supportive relationship. Permanent alimony ends upon the death or remarriage of either spouse.

Durational

Durational alimony is often awarded when no other form of alimony is appropriate, and it is usually awarded for short- and moderate-term marriages. It does not last longer than the duration of the marriage. The amount of alimony payments can be modified, but the time period of the entire award may not be changed.

Pendente Lite

Pendente lite (temporary alimony) is to last only from the point of separation until the divorce (in other words, it is to last only through the divorce). The purpose of this is to allow the economically disadvantaged spouse to gain some financial equality, and it may be modified. But it may not be waived (released) by contract, and the finding of a supportive relationship does not automatically terminate it. Any combination of these types of alimony may be awarded. Notably, palimony is not available in Florida.