What Is Palimony?

Palimony is a form of financial support available to people who were never married but formerly lived together as a couple and are now separated. This type of support is calculated separately from child support and alimony.

Unmarried couples often live together. As a result, unmarried partners acquire property together as a couple. If such a couple splits up, they may seek to divide their mutually owned properties and encounter disagreements in the process.

In some states, the law has put measures in place to resolve these types of disputes.

Jump to: Palimony States | Palimony Agreements | Palimony Suit | Palimony Payments Factors | Palimony Payments Qualifications | Palimony Modification

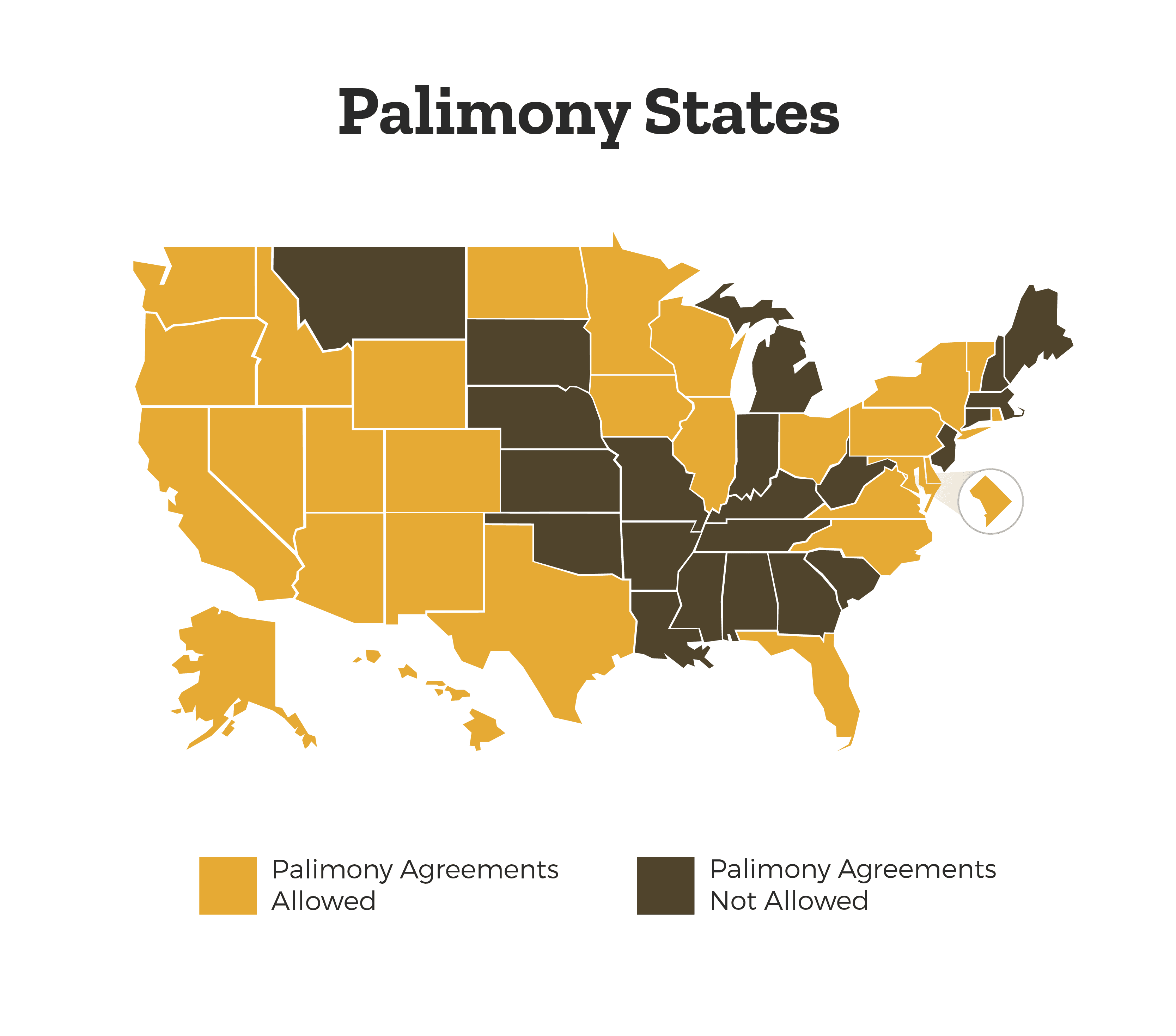

Which States Allow Palimony Agreements?

These states allow palimony agreements or some form of them:

- Alaska

- Arizona

- California

- Colorado

- Delaware

- Florida

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Maryland

- Minnesota

- Nevada

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oregon

- Pennsylvania

- Rhode Island

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Wisconsin

- Wyoming

What are Palimony Agreements?

Palimony was established in the 1976 California landmark case of Marvin v. Marvin. The court found that “in the absence of an express agreement, courts may look to a variety of other remedies to divide property equitably.” The California Supreme Court also recognized that despite the state’s abolishment of common law marriage in 1896, California still recognizes contracts made between couples outside of marriage. So general contract principles apply, and the party seeking to enforce a contract must legally prove that a valid contract was formed.

The agreement may be express or implied, oral, or written. The contract may also include provisions for a sexual relationship. However, these provisions will not be enforced if they are based on an illegal exchange involving sexual services. Also, the traditional defenses to contract formation are applicable. For instance, agreements formed subject to fraud, duress (improper physical, financial, or legal threats), incapacity (e.g., parties under the age of majority, guardian ad litem), failure to comply with an applicable statute of frauds (transfers involving ownership interests in land must be commemorated in a signed writing that states the essential terms of the transaction, including an adequate legal description of the land), and unconscionability may be asserted to prevent the enforcement of a cohabitation agreement.

How to File A Palimony Suit?

To begin a palimony suit, the party seeking to enforce an intercouple promise must file a petition with the court in which they seek to enforce their claim.

This court would most likely be located in the last place in which the couple lived together as a couple. However, other courts could be selected as an appropriate venue, as dictated by fairness and other procedural rules.

Each of the parties to a palimony suit may hire a family law attorney or law firm of their choice, but an attorney will not be provided by the state at no cost. Also, the parties will not be entitled to a trial by jury.

Palimony Can Vary by Your State

Notably, there are states that do not award palimony but do recognize palimony awards granted in other states pursuant to the full faith and credit guarantees provided by the U.S. Constitution. For instance, Florida does not permit recoveries relating to palimony claims in its family law provisions. Although, Florida law will enforce out-of-state palimony awards if these claims are based on a valid final judgment (the court has reached a decision and actually decided to award palimony, so the case is no longer pending a decision). However, the court may enforce a palimony award even if it is subject to a pending appeal.

A Florida court of appeals solidified this position in the case of Poe v. Estate of Levy. In this case, an unmarried plaintiff sought an award of half of his deceased partner’s estate in family court. The plaintiff alleged that the parties had lived as husband and wife and subsequently entered into an implied cohabitation agreement that he claimed included the parties’ intent to “… pool their resources and funds in common bank accounts, for the purpose of acquiring property and paying for the necessities of life,” among other claims.

The appellate court decidedly ruled that even if the parties had been married, that would not automatically entitle anyone to half of the deceased’s estate. The court further elaborated that “to allow the appellant to make a claim against the deceased’s estate on the same basis as if the parties had been married would, in essence, constitute implying in law a marriage that never existed contrary to the law in Florida abolishing common-law marriages and establishing certain legal prerequisites to establish a valid legal marriage. No jurisdiction to our knowledge has gone this far.”

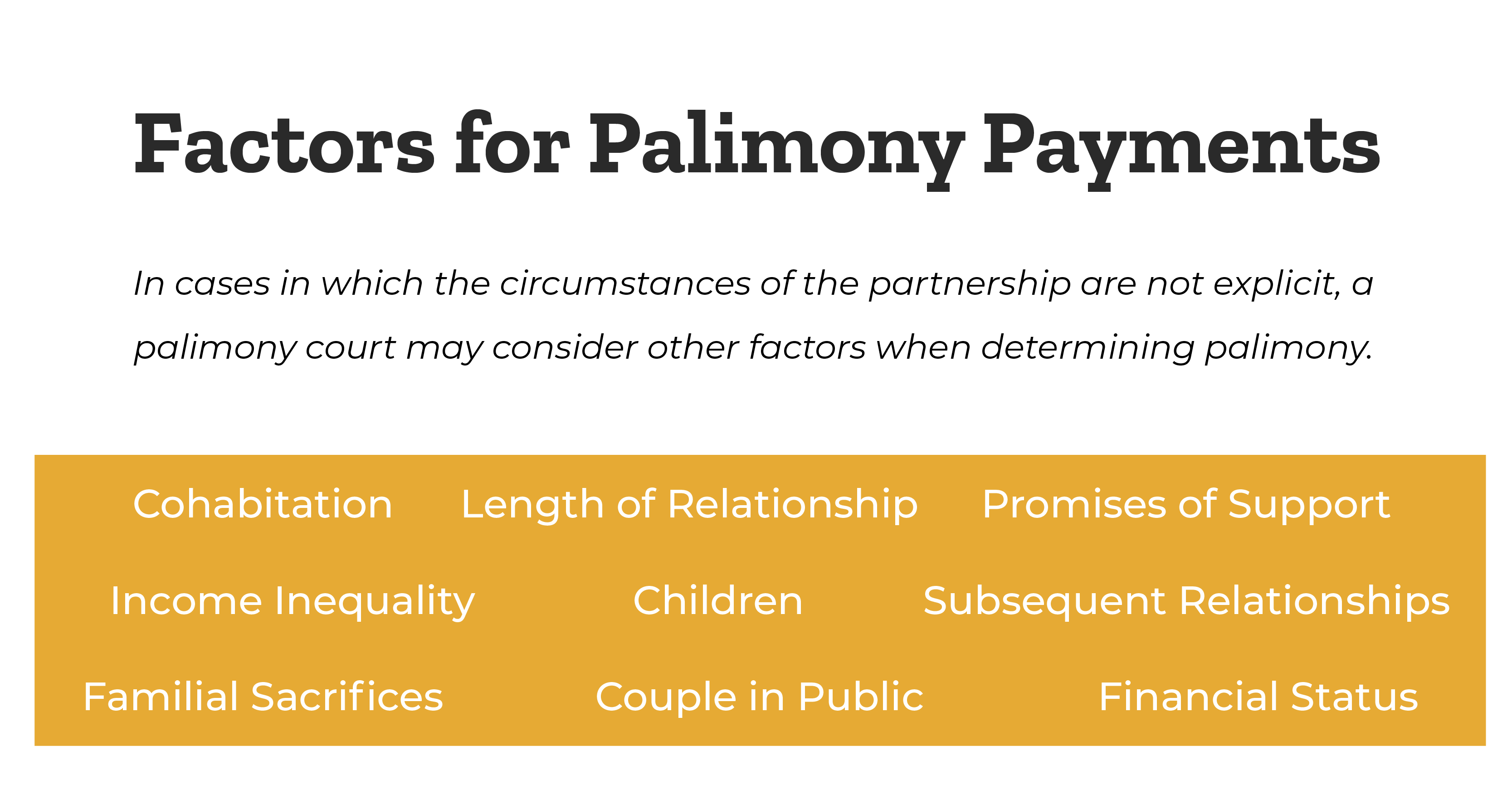

What Are The Factors For Palimony Payments?

In cases in which the circumstances are not so clear, a palimony court may consider certain other factors such as:

- cohabitation (domestic partners)

- length of the relationship

- promises to provide support made by one party

- written financial agreements

- the financial positions of each party

- income inequality between the parties

- the existence of inter-relational children

- sacrifices made for the career advancement of the other party and/or raising children

- whether the couple generally held themselves out to the public as husband and wife

- the existence of a new supportive relationship (e.g., one party has since been married).

If the party seeking to prove the existence of an intercouple agreement fails to prove that such an agreement was formed (as was the case in Marvin), the court will deny a palimony award.

What Are The Palimony Payment Qualifications?

The principles upon which palimony may be awarded are quite similar to alimony (spousal support) except that it may be awarded without a legal marriage.

Being that marriage is based on an express contract (typically an oral promise of intent to be married), palimony courts will look at the circumstances surrounding the couple to determine if the couple intended to form a contract without being married.

A written contract would quite obviously satisfy this requirement, and courts will first seek to find if a written cohabitation agreement was formed. However, a written contract may not be required for the court to find that a couple intended to form a contract.

In which case, the court will admit extrinsic evidence (evidence relating to a contract that does not appear in the contract itself) to determine if oral promises may be enforced.

Can a Palimony Award Be Modified?

Typically, palimony awards may not be modified. In some cases, however, the payor partner is able to demonstrate a substantial change in circumstances that significantly affect their need to receive or the ability to pay support. This can be shown by either a change in the financial needs of the payee or a change in the payor’s ability to continue paying the same amount. A court may also consider the voluntary retirement of the payor from the labor market in these situations. However, a party may not modify their support payments based on a voluntary reduction of income.

For example, if a payor partner intentionally quits their job, the payor may not modify to reduce their payments due to this (being that it was intentional). To obtain a palimony modification, the party seeking to modify must file a petition in a court that can exercise jurisdiction (control) over the palimony case. The petition must state the reasons for the modification. Thereafter, a hearing will be scheduled to determine if a modification is justified. The other party must receive advanced notice of the hearing and be afforded an opportunity to attend the modification hearing. However, if the modification is being sought in the same court that originally issued the palimony, jurisdiction does not have to be reestablished.

The principles upon which palimony are based remain unsettled to a certain extent among several states. Thus, a written cohabitation agreement may ease the transition away from cohabitation. A well-drafted cohabitation agreement should thoroughly account for the needs of both parties in the event of a separation. It may be in the best interests of both partners to seek legal advice separately within the protections afforded by a privileged attorney-client relationship. Therefore, hiring an attorney individually (as opposed to mutually) may preserve the property rights of both unmarried partners.