Alimony, or spousal support, refers to financial payments made between divorced people. In New York, alimony is called “maintenance.” The former spouse who is the higher wage earner is the paying spouse or the “payor”; the lower-income earner is the recipient spouse or the “payee.”

Spousal support is a common concern during a New York divorce proceeding. Two people who shared incomes during a marriage are now splitting up and living as individuals. One party may desperately need additional support, whereas another party may not want to continue to make financial contributions to their former spouse.

Alimony Factors

Several factors determine alimony support payment orders. In New York, the applicable maintenance law is found in Domestic Relations Law 236- B (6). The law provides the guidelines for which the former spouse is qualified to receive the funds and suggestions for determining the duration of alimony payments.

The New York law looks at several factors regarding which topics are relevant when considering a claim for maintenance. These include the spouse’s income versus the recipient’s income, the age and health of both parties, the present and future work capacity of both parties, the standard of living during the marriage, the age of their children if applicable, and child support payments. Courts will also look at the parties’ assets and liabilities and consider how the equitable division of marital property may affect the calculation. A support amount may also be affected by certain acts committed by one party, including the marital dissipation of assets or acts of domestic violence that inhibit a party’s earning capacity. On the whole, the potential recipient must show a need for a continuation of support as opposed to a right they feel entitled to after being married to a higher wage earner.

The Domestic Relations Law provides guidelines for determining maintenance; however, no one factor is deemed more relevant in calculating an alimony award. The trial judge has significant authority to determine which factors weigh more heavily in his or her decision for a support order. However, each case is unique to every person and his or her circumstances. If you are seeking to pursue maintenance actions, it is best to seek the legal advice of a qualified New York family law firm or divorce lawyer

Order or Agreement in Writing

New York requires that an order for maintenance must be in writing, either by a support order made in the family court or reached in an agreement. Any premarital agreement with a clause either clarifying alimony or waiving spousal support will be upheld and implemented.

Additionally, any written agreement made during mediation or in settlement talks will also be implemented by the family court. If one is not able to come to a consensus, then the issue will be decided by a family law judge, who has the discretion to determine the award based on the factors set out in the Domestic Relations Law.

Alimony Claim Must Be Brought at Time of Divorce

A request for spousal support must be brought on as an additional claim to be litigated in any New York divorce action. Failure to ask for a maintenance award upon filing or responding to the claim may prevent the judge from litigating the issue at trial. Upon making a claim for spousal support in a New York divorce, each spouse must provide full disclosure of finances. This includes all listing their marital property as well as each spouse’s income, liabilities, and properties and assets. In addition to a family court action, spousal maintenance can be set by mutual agreement and enforced by the court.

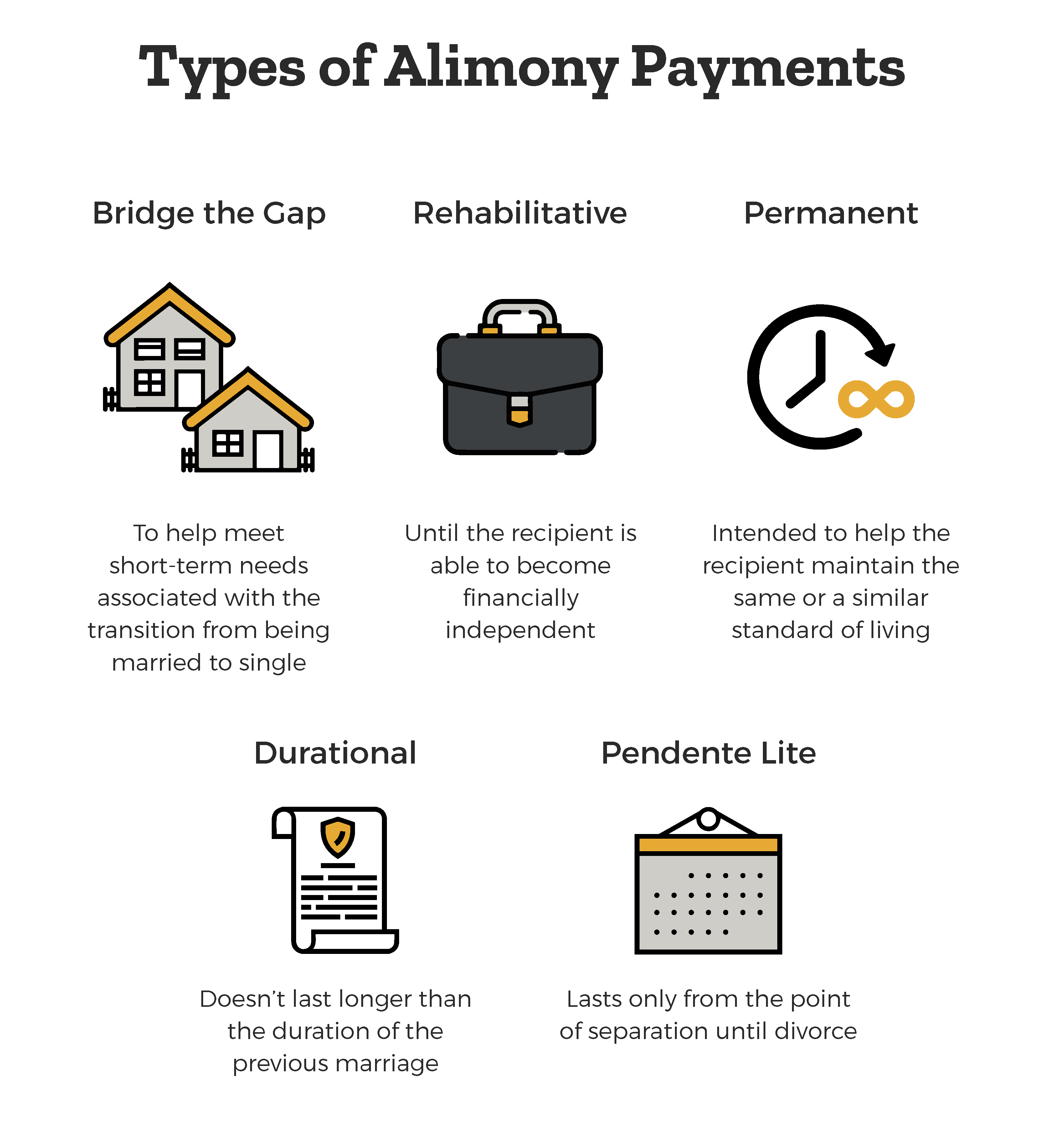

Types of Maintenance – Temporary, Rehabilitative, Permanent

Alimony can be awarded in several ways: It can be temporary, rehabilitative, or permanent. Maintenance ends when the support order or agreement states that it will end. All divorce maintenance can be terminated by the death of either spouse or when the recipient spouse either remarries or cohabitates with another person while relying on their new partner’s financial support.

Pendente Lite Alimony – Temporary Maintenance During Divorce litigation

During a New York divorce action, the lower-earning spouse may file for a pendente lite motion for temporary alimony. A pendente lite alimony order is different from a final support order in that it is only given for temporary maintenance while a divorce case is still pending. Courts often award divorce maintenance when the lower-income spouse is not self-supporting during the litigation. The court will also consider the likelihood that the party may need support for the period in consideration of the stress and costs of the litigations, including a divorce lawyer.

The award for divorce maintenance is a temporary alimony order only intended to be valid up to the time of the final judgment. It is not intended to last forever. At the divorce trial, spousal support will be looked at anew upon reflection of the factors in the New York family law. Therefore, a pendente lite award is not necessarily an indication of what someone’s post-divorce maintenance may be. In fact, there might not be any support award at all after the divorce is finalized.

Temporary Alimony for Rehabilitation

The court also gives fair consideration to the ability of the recipient spouse to be self-supporting. The court looks at the education and experience of the recipient spouse, including present and future career opportunities. Sometimes, one must receive alimony for a short duration to help get back on his or her feet. During this time, an alimony payment is given to help offset the cost of living until the receiving spouse can fully develop his or her earning capacity. The court will order a time limit for the paying spouse: The recipient spouse is expected to either complete education and/or find career opportunities by the time the alimony award ends.

The duration of New York alimony is determined by the length of the marriage. A marriage of just a couple of years will rarely warrant a spousal maintenance award, yet a marriage of 15 years or more demonstrates longer dependency on the former spouse’s income. If a recipient spouse can show that they gave up on receiving an education or abandoned a career for a significant amount of time to be a homemaker or raise children, then the court may find they need alimony for a longer duration before they can get back into the workplace and find meaningful employment.

Permanent Alimony

An award of permanent alimony is an award of maintenance until either spouse dies or is remarried. Permanent New York alimony awards have become quite rare. For this to take place, a couple would have to have been in a long-term marriage. Generally, marriage for 20 years or longer is considered a marriage of long duration. With longer marriages usually come older people at the time of divorce. If a person was married for several decades and did not work for the length of the marriage, then they are more likely to be elderly and/or have been away from the workplace for a considerable amount of time. They might have already passed retirement age and, even with their skill set, would not be able to match the earning capacity to be self-supporting. As such, a court may find it necessary to have permanent spousal maintenance, as it is unlikely for them to return to the workplace.

Health Insurance

A court may also order that a spouse be required to either maintain or purchase health insurance for the other party. The period required to furnish the insurance terminates when the order for alimony ends.

Tax Consequences of Alimony

New York courts also consider the tax consequences of the parties in paying/receiving alimony payments. Traditionally, alimony is deductible from the paying spouse and is considered “income” taxable to the receiving spouse. For spouses who divorced after Dec. 31, 2018, these tax consequences still apply but only to New York’s state taxes. Per the Tax Cuts and Jobs Act, alimony payors and payees no longer need to report maintenance payments as taxable income on federal tax returns.

Gender Neutral

The New York maintenance law is gender-neutral, meaning either spouse may qualify to be the recipient spouse. The law does not look at gender and focuses on which person was the higher wage earner.

Alimony Payments Must Be Monetary Payments

New York requires that alimony payments be made in cash. Alternative compensation, such as services or goods, does not qualify, as they are not direct cash payment to the receiving spouse.

Palimony

“Palimony” is a term that refers to maintenance payments between a former couple who was never legally married. The concept behind palimony is similar to alimony in that a former companion has to show that they were financially dependent on the other party and that it would be fair and just to continue financial support. Generally, a person must show a relationship similar to that of a common-law marriage to warrant palimony maintenance support.

New York family law requires that both parties must have been married before an action for spousal maintenance can be determined. Alimony is specifically related to divorcing couples, and New York law does not provide any provisions for palimony. Unmarried couples in New York, particularly if they cohabitate, may benefit from forming a contractual relationship agreement that clarifies property rights and equitable distribution after a breakup.

Difference From Child Support

Domestic Relations Law also provides guidelines for child support orders. However, spousal support is a different and separate category. Child support is a court-ordered support payment awarded to cover the costs of raising minor children. Payments given for any costs related to a child, such as day care or health insurance benefits, will be regarded under child support, even though they may also financially benefit the lower-income earner.

Additionally, any agreement that states the duration of alimony ends when all children have reached the age of majority is deemed invalid for alimony. In this case, the payments would be considered as child support, as one does not continue to pay the custodial parent for the support of adult children. Temporary maintenance may be prescribed for a period of time; however, payments that coincide with the cost of raising children will be classified as child support.