What Is A Business Partnership?

A business partnership is a legal association of two or more people who are engaged as co-owners in a for-profit business organization. A person under partnership law is defined as an individual, corporation, or trust.

- A partnership is its own separate legal entity, distinct from its individual partners.

- A partnership also must have a legally valid purpose; thus, a partnership formed to further an illegal enterprise or to break laws is void.

- Co-owners are also free to form different types of partnership, all with varying degrees of personal liability attributed to their business organization.

In the U.S., general partnerships are governed by the Revised Uniform Partnership Act (RUPA). If business partners agree to govern their organization differently from state law, they can provide the details of their decision-making in a written agreement. However, issues that are not specifically provided within the partnership agreement will be subject to RUPA law.

How Business Partnerships Are Formed

A partnership can be formed by two or more people who contribute money or services to a business in turn for a share of the profits. A partnership never is formed with just a single person, as this would form a sole proprietorship instead.

No formal writing is required for establishing a partnership; parties’ intent may be implied by their conduct. However, due to the statute of frauds, if the parties wish to have their new business exist for longer than a year, then they must put their intentions in writing to satisfy state law.

The new partnership may file a statement of their partnership agreement with the secretary of state, which acts to give constructive notice of the partners’ authority to bind the partnership.

A person must be “competent” to enter into any type of partnership. To be competent means they are of age and have the legal capacity to enter into contracts. However, a partnership formed with one or more incompetent people will not automatically void a partnership as a business entity. Instead, the partnership will operate as such until it is dissolved. However, any partner who lacked capacity will be determined only to be liable to the extent of his or her capital contribution and not personally liable to any partnership debts or tort cases.

Generally, a contribution of personal assets, money, or services in return for a share of a business’s profits forms the creation of a general partnership. The general partnership will be established unless the partner’s share of the profits is used instead for payment of a debt, interest on a debt, rent, the services of an independent contractor, retirement or pension plan, or for the sale of the goodwill of the business.

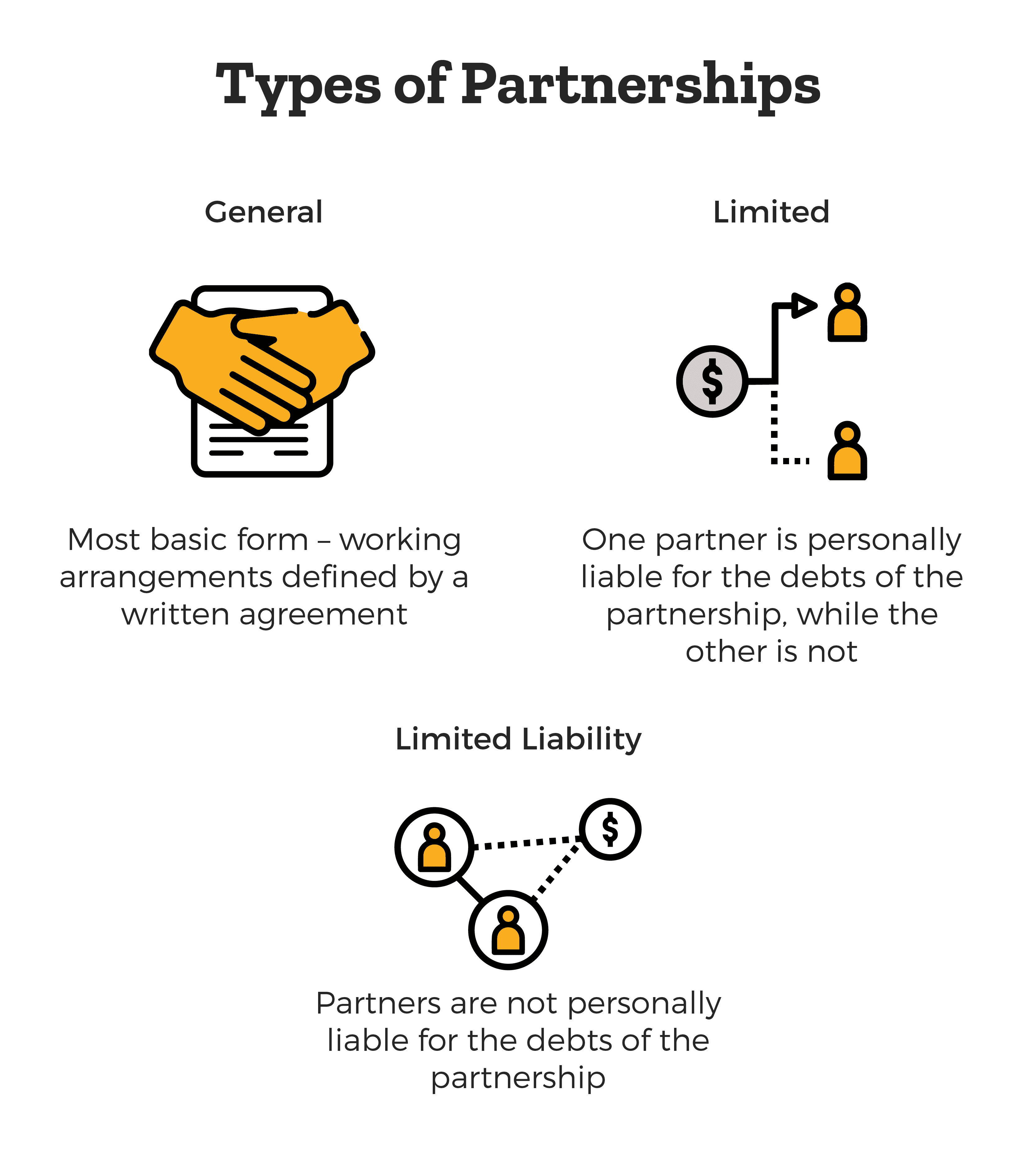

Types of Business Partnerships

- General – working arrangements defined by a written agreement

- Limited – one partner is personally liable for the debts of the partnership, while the other is not

- Limited Liability – partners are not personally liable for the debt of the partnership

Limited Partnership

A limited partnership is a legal entity with one or more general partners and one or more limited partners. The general partner is fully liable in his or her individual capacity to the obligations of the business and partnership’s debts. A limited partner, however, is not personally liable for the debts and obligations of the partnership.

A limited partnership can only be established with filing certification papers subject to the state law with the secretary of state.

Limited Liability Partnership

A limited liability partnership, or LLP, is a legal entity where partners are not personally liable for the debts of the partnership but will be limited to liability for their own personal wrongdoings.

A general partnership can become a limited liability partnership upon approval and vote, subject to the partnership agreement to amend the business structure. If the written agreement does not state how the partnership may be amended, then a unanimous vote of all the partners is required to approve becoming an LLP.

Upon approval of becoming an LLP, the partnership must file a statement of qualification and annual reports detailing their yearly income tax with the secretary of state.

Limited Liability Company

A limited liability company is a hybrid business entity that has an income tax structure like a partnership but can operate as a partnership, corporation, or even like a self-proprietorship. The owners of the new business are called members and have limited personal liability similar to that of shareholders within a corporation. There is no requirement as to the number of members a limited liability company can have, but at least one member must file a certificate of organization papers subject to the state law with the secretary of state.

What Are Business Partner Fiduciary Responsibilities?

All partners have fiduciary duties, or legal and ethical responsibilities, to the partnership. Those responsibilities include:

- duty of care

- duty of loyalty

- duty of good faith and fair dealing

The duty of care involves refraining from negligent, reckless, or unlawful conduct in connection with the business.

The duty of loyalty is an obligation to put the business interests first. An individual partner cannot “usurp” the partnership’s opportunities for their personal interest. Individual partners must account for all profits and turn them over to the partnership. A partner cannot stray away from the partnership and conduct secret deals.

The duty of good faith and fair dealing requires each partner to be fair and honest conducting their business deals and connections.

Rights of Partners in a Business Partnership

All partners have legal rights bestowed on them as a part of the partnership entity. These include the:

- right to profits and losses

- right to share in the management and decision-making

- right to inspect

- right to contribution

- right to indemnification

- right to legal action

- no right to remuneration

Right to Profits and Losses

All partners share equally in the partnership profits and losses unless there is an agreement specifying otherwise.

Right to Management

All partners have a share in the management of the business unless there is a written agreement specifying otherwise.

All partners have an equal “one partner, one vote” in decision-making, and any differences that may come up in the ordinary course of the partnership are decided by a majority vote.

Right to Inspect

Each partner has a right to inspect the business partnership’s books, which must be maintained at the partnership’s headquarters. Each partner must provide an account of what has been recorded within the partnership property if another partner asks him or her.

Right to Contribution

All partners are personally liable for all debts and obligations of the partnership. However, if one partner has paid more than the other partner’s share in liability, they have a right to contribution, or repayment, from the other partners.

Right to Indemnification

A partner has a right to reimbursement for any expenses they paid to benefit the partnership during the ordinary course of the business.

No Right to Remuneration

A partner does not have a right to remuneration, or a salary, in exchange for his or her services to the partnership, except for reasonable compensation that occurred during the winding down/up of the business.

Right to Legal Action

A partnership retains the right to sue a partner if they breach the partnership duties specified in their written agreement.

A partner retains a right to sue the partnership (or another co-owner of the business organization) to enforce a right or duty that was breached of the partnership agreement.

What Are Your Liabilities In A Business Partnership?

Generally, partners have the authority to act when they are conducting any type of business that falls within the scope of the partnership. The most common areas of liabilities are:

- Binding contracts

- Tort actions

- Debt liability

- Criminal liability

Binding Contracts

As partners are agents of the partnership, they have the authority to bind the partnership in contracts they make on behalf of the partnership to the extent that they have been authorized to do so.

Other partners will be liable for contracts entered by a partner unless it can be shown that the partner did not have the authority to act and enter into such a contract on behalf of the partnership.

This can happen when the business conducted was not related to the work of the partnership, or if the third party knew the partner lacked such authority to enter into such a venture.

Tort Actions

Partners are liable for all tort actions and partnership debts incurred during the ordinary course of the business.

Business Partner Debt Liability

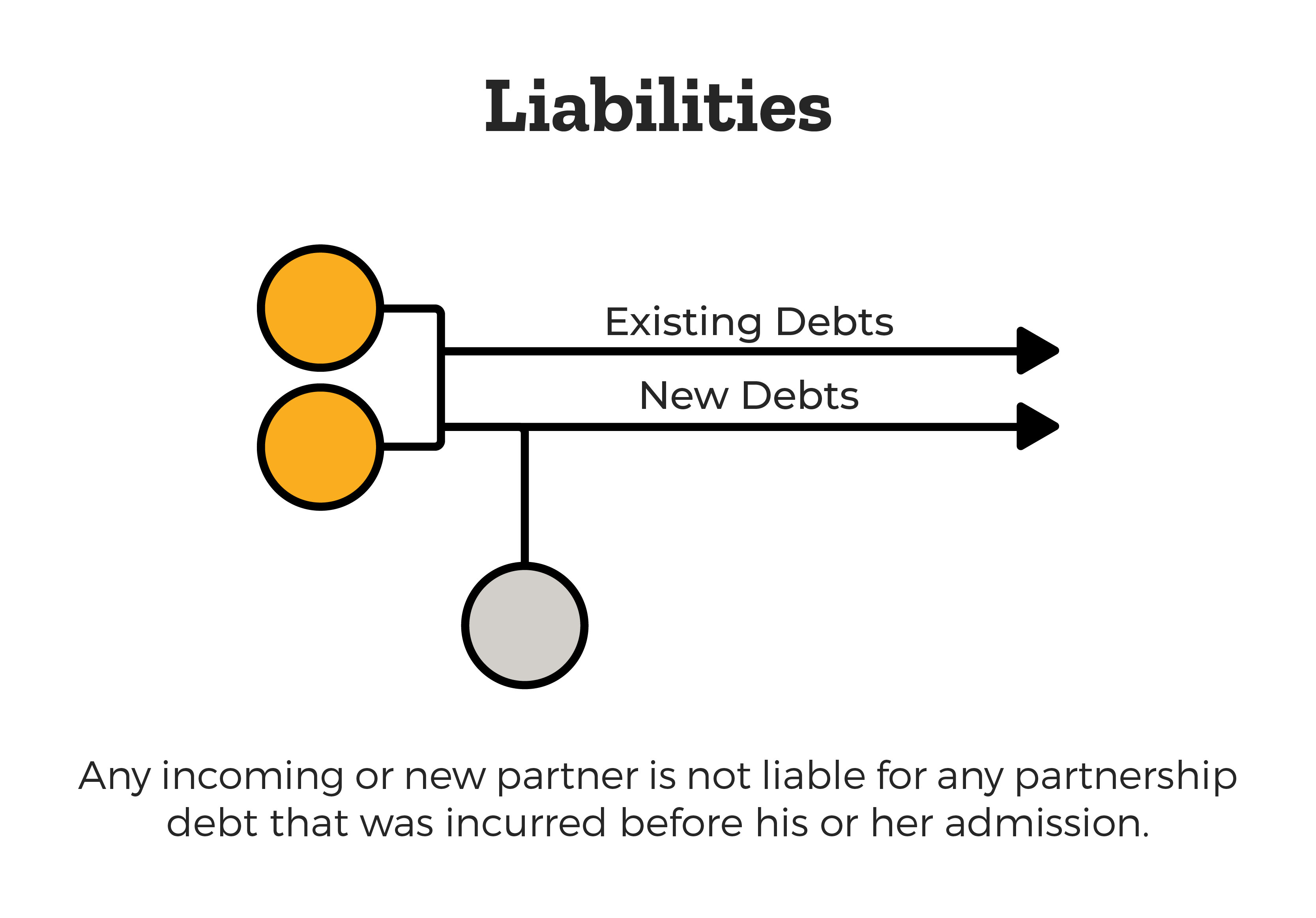

Any incoming or new partner is not liable for any partnership debts that were incurred before their admission as a new business partner.

Any outgoing or dissociating partner will continue to be subject to liability for partnership debts incurred during the time they were still a part of the partnership.

After dissociation, notice must be given to any third-party business associate of the individual partner’s exit; otherwise, without the knowledge of the exit, a third party can still collect debts from the former partner for up to two years.

Business Partner Criminal Liability

No partner will be held criminally liable for crimes committed by another partner within the scope of the business unless he or she was an accessory to that specific crime.

How To Dissolve a Business Partnership

Business partnership dissolution is the process of ending a partnership business. A partnership may dissolve due to many reasons, such as:

- financial bankruptcy

- by written agreement by all partners to move on

During dissolution, the legal entity must officially “wind up” all aspects of the partnership, including:

- settling debts

- distributing partnership property and assets

- ceasing doing business

After the winding up period is complete, the partnership is legally terminated.

Business partnership dissociation occurs when a partner ends his or her association with the partnership and terminates his or her status, duties, and responsibilities of the business. A business partner has the right to dissociate at any time.

A partner may dissociate by choice or by an event agreed to in the partnership agreement. A partner who dissociates in violation of a contract may be liable to pay damages to the partnership.