Child support is a court-ordered judgment to provide financial support for minors. The obligor, or noncustodial parent, makes payments to the custodial parent to provide for the child’s basic needs.

The issue of child support is governed separately within every state. In the jurisdiction of California, the applicable law is governed by the California Family Code, of which Section 4053 states, “A parent’s first and principal obligation is to support his or her minor children according to the parent’s circumstances and station in life.”

Determining Child Support Payments

A California child support award is determined based on several factors. The formula first considers the monthly income of both parents. Additionally, the income of the higher-earning parent is offset according to the amount of time they spend with the child.

The amount of support will also increase with the number of children the parents share together, with a greater amount of support added for each additional minor. Under the Florida Family Code, a child is considered a “minor child” until the child turns 18; if the child hasn’t completed high school by age 18, then they will be a minor until age 19 or until they graduate (whichever comes first).

Income and Deductions

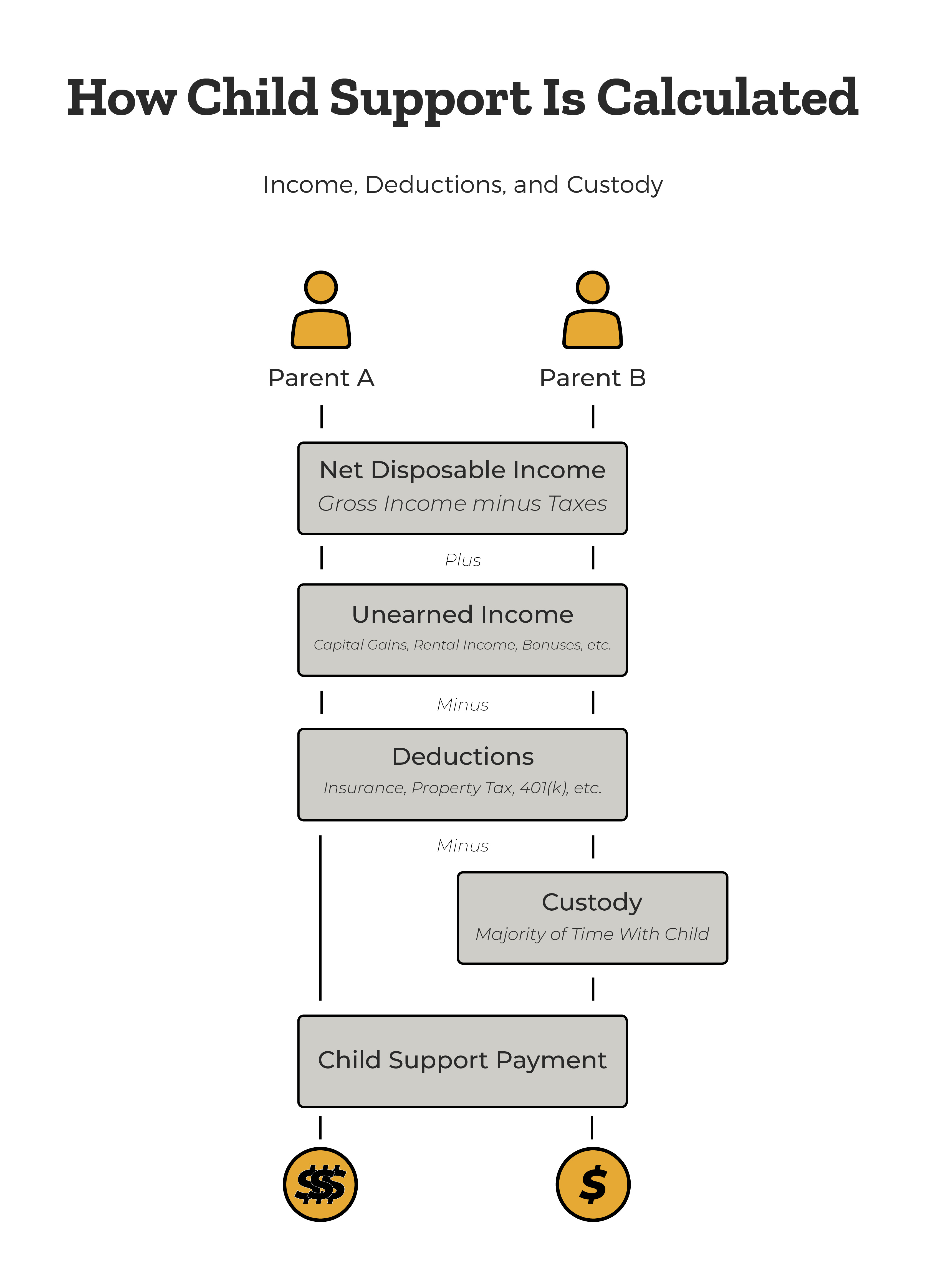

The family court looks at the “net disposable income” of both parents to determine the income levels. For a “net disposable income,” the court considers each parent’s individual annual net income after taxes. This is determined by looking at a person’s gross annual income, then subtracting the income taxes they pay. Generally, the court requires that the parties submit the income tax filing from the past year to help calculate the amount of child support. The judge considers both parents’ income and looks to see how the noncustodial parent’s income is different from the custodial parent’s, which would indicate the difference he or she is required to pay them.

Subsequently, the court will also add any additional “unearned” income to the calculation, such as payments the parties received from spousal support, rental incomes, stock earnings, commissions, or bonuses.

Next, deductions are made to the net disposable incomes to determine the basic child support calculation. Credit is given for usual taxable deductions, such as health insurance, property taxes, mortgages, and child care expenses. The court can also include deductions for Social Security payments and job-related deductions like mandatory retirement contributions or union dues. Additionally, a parent will generally be given credit if they are currently paying child support for any other minor children outside of the current child support case.

Online Child Support Estimator

The child support calculation is a complex mathematical formula. The family court is solely responsible for calculating the amount of child support according to California guidelines. However, one can get a ballpark figure of their potential amount at https://childsupport.ca.gov/calculate-child-support/.

What Makes California Different – Special Considerations for Children’s Lifestyles

The California child support guidelines will generate a minimum award amount. The state legislature, however, gave the family law court discretion to order a larger amount of child support in special circumstances. This was to help child support cases that have parents with extreme discrepancies in income. In these cases, a judge will look at the child’s standard of living enjoyed before the separation of their parents. If the child was accustomed to living with an extraordinary level of financial support, the court has the discretion to award a larger amount of child support than the minimum amount calculated.

How to File for Child Support in California

There are several ways to initiate a child support order in the state of California. Only a parent or legal guardian is allowed to apply for child support of a minor. One can file a motion within the family law court or fill out an application at their local child support agency (LCSA).

All child support cases are managed by the California Department of Child Support Services (DCSS). The office receives and files applications with the court and can provide information and support during the complex child support process. One can apply either online at the California DCSS website or at the local child support office in the county where you or the child has lived for the past six months. Every county has an LCSA, and they can accept walk-in applications.

When submitting a California child support application on the DCSS website, the parent will first need to create an online account and provide contact information. They will then be directed to fill out general information and financial details. A parent can access the online application to file with DCSS at https://childsupport.ca.gov/apply-for-child-support/.

How Child Support Is Paid

Child support payments are controlled through the State Disbursement Agency. The agency is a separate entity from DCSS and acts as a third party to support the collection and distribution of financial support.

An obligor can pay child support by money order, credit card, PayPal, or electronic funds transfer (EFT). The obligor has the option to pay by mail, online, or over the phone. Additionally, they can pay in person by cash or credit card at a PayNearMe kiosk available at many grocery and convenience stores throughout the state.

The person receiving the support can decide if they want to receive the funds by direct deposit, check, or on an electronic payment card/prepaid credit card.

Sometimes, the court may include instructions for the child support payments to be garnished directly through the obligor’s paycheck. If there is an Income Withholding Order, the employer of the obligor will be instructed to deduct the payment from the obligor’s wages. The money will be sent to the Disbursement Agency, which will send it to the receiving parent.

Medical Support

Every child support order will also include a “Medical Support” order. This provides a stipulation requiring a parent to provide required health insurance for the minor, if available at a reasonable cost.

Child Support Arrears

California is a state that takes child support payments very seriously. If a child support payment becomes delinquent, a custodial parent may make a request to the LCSA for a motion of enforcement against the noncustodial parent. Within 30 days of the request, the local child support agency must respond to whether they will grant the request and proceed with the case. The LCSA generally will approve the case if there was considerable time without any amount of child support paid. There are many ways in which the obligor may be sanctioned.

One of the first actions the state can take is license suspension. License suspension is not only limited to driver’s licenses but any business or professional licenses a person may hold. Thus, it can create a huge impediment if a person’s career involves having a currently registered license. The license will be suspended until the complete balance has been satisfied according to the court.

Additionally, California is particularly hard on child support violators by charging interest on the past-due child support. California Code of Civil Procedure Section 685.010 states that child support arrears are to be charged an annual 10% interest rate. It is good to be aware that any noncustodial parent who has fallen behind on payments can contact LCSA to work out a repayment plan for settling the debt.

Furthermore, the state of California can take even more drastic measures against the obligor when there is a huge arrears balance, coupled with extreme indifference to pay. In these child support cases, the state can file criminal misdemeanor charges or even garnish one’s pay or tax refunds to satisfy the debt.

One is never allowed to stop payment of child support without a court order instructing otherwise. If one is having trouble paying child support, whether due to financial problems or circumstances beyond their control, it is best to first apply to the court for a change in the child support calculation. Until then, it is never acceptable to suddenly stop paying or be late with child support.

How to Modify Child Support in California

The child support calculation remains the same absent a court order. One can modify child support in California by filing an Order to Show Cause within the court. A support order will only be changed by the court if there has been a significant change in circumstances. Such circumstances must be either a significant change in custody or parenting time or a permanent change that now affects the financial earnings of either party.

A child support order will not be changed for brief periods of financial unrest or for issues unrelated to one’s competency for work or income earning capacity. Thus, a parent will still be held to their previously established earning capacity standard even if they have temporary unemployment. Further, the court will not change the order for a parent who has made poor financial choices and is low on money. Additionally, a support award will not be changed when a parent is withholding the other partner’s visitation. This, however, would be in violation of the custody order and the noncustodial parent could bring a motion to enforce the parenting time plan or to change custody.